European-wide solutions

The European payments market is complex and diverse; it is different by national community across the SEPA according to consumers and merchants choice of payment instruments to transfer funds.

Providing efficient solutions to the banking industry

Regulation, competition, technology and market demand are fast evolving the payments market.

Our role as a Clearing & Settlement infrastructure is to ensure the secure and efficient exchange of transactions between the participants in our system and to lead the wave of change to provide new services to our payments community in support of their evolving business requirements.

Our services portfolio aims to provide PSPs across SEPA an integrated solution for Clearing & Settlement for all payment instruments through a Single Access. This approach allows PSPs to significantly reduce internal operational costs in relation to participating in multiple systems for the different payment instruments, as well as reducing PSP’s liquidity requirements through optimised consolidation of the settlement obligations in a net position.

.png)

Instant Payments

STET is in the process of implementing a new CSM for the SEPA SCTinst scheme to be launched in November 2017. The instant payments scheme is driven by regulation, competition and market demand. Supported by new technologies instant payments inevitably will become the new normal.

To meet this challenge, STET is delivering a new CSM built for the future. Based on our highly resilient and secure clearing infrastructure and an equally secure and robust real time 24/7 messaging platform, STET will deliver a new generation system scalable to pan-European capacity and delivering instant payments clearing and settlement in seconds.

The main features of the SCTinst service are:

- Instant messaging 24/7 based on our real time processing experience.

- Less than 1 second for CSM processing

- Orchestration of Business and Technical message flows and Timeout management and reporting

- Instant Multilateral net Clearing based on Mirror Accounts reflecting the collateral placed by participants to guarantee settlement.

- Multilateral net Settlement in TARGET2 ASI interfaces

- Integration of the Clearing and Settlement components to allow collateral and liquidity management including alert messages

- Web services to provide on-line information services in support of Operational and Treasury functions

Value Added services that may be required by participants:

Fraud scoring based on our card fraud scoring tools

- Proxy data base to securely retrieve BIC/IBAN from mobile number

- Tokenisation for the protection of sensitive data

- Transaction Value Date mismatch reporting/clearing & settlement

- Very competitive pricing based on our established market position

Multi-CSM

The payments industry work has come a long way in delivering the harmonisation of the 33 billion annual credit and direct debit transactions, into a single set of Scheme Rule Books and messaging standards. However, a number of small differences remain at national implementation level to support market demands and practices.

It is a reality: the new European payment landscape remains fragmented. Diversity must be seen as a strength and a source of innovation rather than an obstacle.

Banking communities across Europe are faced with critical decisions on how to consolidate their payments without losing governance and autonomy. SEPA, non-SEPA, cards and non-euro payments are all pieces of the new puzzle to assemble.

Supporting the different clearing models

In addition to the diversity of payment instruments in the European market, the most common variant in the Clearing and Settlement arrangements is the Clearing Model.

Two main Clearing Models exist:

- Multilateral exchanges with multiple intraday cycles (2 to 10) on a Delivery - After - Settlement model to provide finality to the delivered transactions.

- Multilateral exchanges with real-time clearing and continuous delivery of transactions where finality is provided through a guarantee pool.

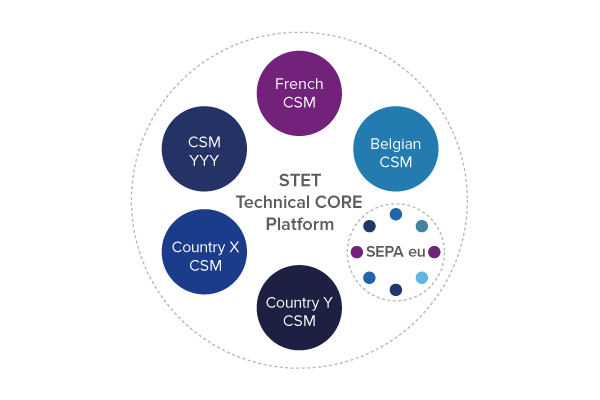

Our CORE platform operates today a number of CSMs on a common technical architecture for access, processing and reporting. However, each CSM is separately configured to clear and settle according to the specific requirement of the community, whether on continuous (France) or Multi-Cycle (Belgium).

We deliver efficiencies from technical consolidation while supporting community differences in their clearing arrangement.

Shared technical platform

Our Multi-CSM offering is thus designed to mitigate the impacts of system consolidation while providing immediate benefits through economies of scale. Larger volumes of transactions contribute directly to the decrease of the per-unit cost. A technical layer common to all hosted CSMs ensures rapid adaptation to technological evolution and reduces operational overhead.

Full range of payment instrument covered

Built from the ground up on XML technology, the CORE platform in a Multi-CSM configuration can host any of the following:

- SEPA schemes

- Non-SEPA and niche products

- Euro and non-Euro payments

- Cards

- Instant payments services

- AOS and regional services

Independent governance per community

Our approach emphasizes the need for self-governing communities to have their own set of market practices.

Flexibility to support different models: Multicycle or continuous with a Guarantee Fund

Whilst our communities (nowadays, France and Belgium) exchange their transactions on a real-time basis all day long, the number of settlement cycles is defined by each community.

Depending on each community choice, settlement can be made : either on a 'delivery-after-settlement' model, or all-day-long with a guarantee fund system.

For the French Community, operations are processed on a real time basis all day long with one daily settlement in Target2. This settlement model is dully ensured by a guarantee fund.

Provisions included in the security mechanism aim at guaranteeing the purpose of operations, thus securing payment flows processed by the CORE(FR) system and settlements at the end of the day.

For the Belgian Community, STET implemented 5 settlement cycles with a ‘delivery-after-settlement’ model that allows mitigating the liquidity risk.

Both examples illustrate the various options supported by our multi-CSM platform.

Specific community value added services

Flexibility and adaptability in hosting payments services are keys in the transition from existing systems to the Multi-CSM environment. Migration risks and costs are reduced whilst the existing services can keep operating as usual without interference in governance. Banking communities can therefore keep fostering innovation on their own payment system without running the risk of isolation.

SEPA.eu

SEPA.eu is a modern state-of-the-art pan-European CSM for Clearing and Settlement of SEPA SCT, SDD Core and B2B transactions.

SEPA.eu is open to any PSP in the SEPA as Direct or Indirect Participant and offers a highly efficient, robust and cost effective solution for SEPA scheme processing.

In an increasingly consolidated market STET further offers access to SEPA.EU to communities looking to outsource their Clearing and Settlement but wishing to retaining a local governance arrangement and to existing CSMs wishing to externalise the Clearing & Settlement component while retaining value added features at local level.

The service offers technical and business validation, routing and clearing on a delivery after settlement model which eliminates counterparty risk. The service is open 24/6 for clearing exchanges and settles through TARGET2 ASI interfaces on a multilateral net basis through multiple intraday cycles.

Mitigating risk in payments is at the heart of our mission. The evolution of technology has made data protection and fraud rise in the risk mitigation agenda. SEPA.EU has been developed in a future oriented infrastructure, evolving from the traditional ACH batch processing, for processing individual transactions. This allows SEPA.EU to offer fraud scoring as a central feature in support of SCT and SDD schemes.

Our on-line information services are delivered through GUI and A2A messaging for easy integration into PSPs’ own information platforms.

SEPA.EU is delivered at most competitive pricing based on our consolidated volume of over 22 billion transactions a year cleared on a multilateral basis.

Value Added Services

Our Instant Payments CSM emerges as a new generation infrastructure ready for today’s reality and provisioned for future evolutions. CSMs rapidly need to evolve from traditional non-urgent batch clearing to real time single transaction clearing.

The speed of exchanges also reduces the time available for PSPs’ to execute the necessary risk controls.

Accordingly CSMs as trusted partners in the interbank exchanges can play a key role in providing risk mitigation services such a transaction scoring for fraudulent transactions. Consumer expectation for fast reach in P2P payments, addressing the beneficiary through different identifiers such as mobile numbers or email addresses highlights the need for central services and the benefits of collective, shared solutions for the account servicing PSPs.

STET plans implement two new services for PSPs in support of instant payments.

Fraud Scoring

Instant Payments will be used for e-commerce by consumers for the payment of on-line purchases of goods and services. This payment method would be an alternative to a payment with a card; it will be a question of choice. It is to be expected that both consumer and merchant will want the same level of risk mitigation offered today in the cards world, that is to say that transactions are scored on real time by the operator for possible fraud through validation against sophisticated algorithms. STET will implement an instant payments fraud scoring service based on our cards scoring system operating today for over 6 billion transactions a year and which have delivered savings to PSPs of more than 50 € millions per year through fraud detection.

Proxy Database

STET plans to implement a proxy database which will allow PSPs, in the pre-transaction stage, to consult the data base to ascertain the BIC and IBAN of the beneficiary from a given mobile number or email address. The transaction is subsequently presented by the PSp for clearing in the IP CSM. The highly secured service will include enrolment, administration, interaction with unknown addressees and other supporting functionalities.

Card Network

Used every day by millions of consumers to withdraw money, make purchases in stores and pay on the Internet and mobiles - both in France and abroad - our network is in France the reference network for CB, Diners Club, JCB, MasterCard, Paylib and Visa cards.

Our card network routes authorization requests and responses, round the clock, 365 days a year.

These operations follow extremely strict security process, including on the basis of applications or sealed and signed responses.

So that customers can make transactions abroad, outside the coverage of the CB system, our network is connected to gateways established with foreign systems of the CB system partners.

Routing

Our network offers 3 different routing methods:

- Issuer routing based on PAN ranges,

- Acquirer routing which takes into account the destinations defined by the Acquirer

- and technical routing related to a transport BIN.

Our network is able to process 37 different types of transactions, including customer-specific transactions for private usage, thereby meeting all card processing needs.

Our routing tables are sized to accept all payment schemes and of course token routing: CB, Diners, JCB, MasterCard, VISA…

Routing includes rules to ensure service continuity through even load balancing and nominal backups.

Issuer service:

- Two routing plans: cardholder number; or recipient (transport BIN)

- Positive routing: only what is declared is routed (international flows)

- Possibility of defining specific routings for an issuer as well as temporary routings (CAR)

- Routing rules (load balancing or nominal/backup)

- Servers can activate backup on demand

- Internal network timings managed according to the recipients

- Large routing table capacity

- Preservation of server responses

- Issuer activity and availability reporting for each connected environment

Acquirer service:

- Control of the acquirer (whether or not the bank is authorized to access the service.)

- Control of transaction consistency (question / response)

- Guaranteed response offered to requesters

- Possibility of acquirer routing (choice of a substitution destination)

- Acquirer activity reporting for each connected environment

Connection service:

- Two IP-VPN access network operators and SDSL or OF support

- 3DES encryption managed by e-rsb on access networks

- IP flow distribution and IP backup activation are transparent for users

- Timing negotiation for requester and server applications

- Possibility of flow exchanges outside the e-rsb routing (EFES service)

- Activity and availability reporting for each connected environment

Fraud Control

As the electronic payment instruments continue to evolve with faster innovations, fraud increases and becomes more technologically sophisticated.

Fraud control is now more than ever a key challenge for the payment industry.

Tokenisation: Substituting a PAN with a Token

Mobile payments (e.g. HCE) as well as new solutions such as Cards on File and Wallets are based on a tokenization service.

As a result of present market conditions, we developed an agnostic tokenization service.

The engine is part of our network, thereby ensuring performance and reliability levels consistent with the network itself.

Scoring card authorisation

Our card authorisation network leverages high transaction volumes to deliver optmised scoring

Our network uses the IRIS Analytics solution based on statistical models and expert rules to score transaction fraud risk in real time.

The relevance of the score is optimally generated through supervised self-learning algorithms based on large volumes of eligible transactions.

Scoring SEPA

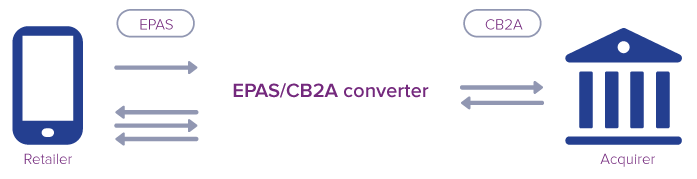

EPAS Protocol converter

As the EPAS standard (ISO 20022) is becoming a market reality and is supported by several major retailers, STET brings solutions to support these new technical needs.

EPAS

Acquiring banks and payment institutions adapt their strategy to deploy new services and technologies such as contactless and mobile payment. To do so, they need to phase out the standard of the card based on ISO 8583 to migrate to ISO 20022, a more open and interoperable standard that supports new services and payment solutions.

This new standard EPAS enables the standardization of regulations on procurement systems through the sharing of common requirements (physical, logical security, etc.) and leads to the establishment of a shared single certification. It promotes, notably in Europe, the interoperability of transactions (payment and withdrawal) by bank cards (debit and credit), developing and maintaining a standard on behalf of its members on the basis of exchanges in ISO 20022.

Our converter supports both versions 1 and 2 of the EPAS protocol in order to suit all the Acquirers requirements. This is how we are helping our clients to reinforce the information security while meeting the cryptography standard formats, and to ensure the protection of the following data:

- Protection of the confidential code,

- Protection of sensitive data from the credit card,

- Protection of the message by an authentication code,

- Protection of the message with a digital signature.

In France, we implemented an infrastructure featuring specially designed resilience to process all the transaction flows for CB2A platforms.